Investing is often thought of as a numbers game—analyzing data, predicting trends, and making calculated decisions. However, there’s another crucial aspect of investing that’s often overlooked: human behavior. This is where the concept of behavioral finance comes into play. Behavioral finance explores how psychological factors influence investors’ decisions, and understanding it can help you make smarter, more informed choices with your money.

What Is Behavioral Finance?

Behavioral finance is a field of study that combines psychology and economics to understand how people make financial decisions. Traditional finance assumes that investors are rational and always act in their best financial interest. However, behavioral finance acknowledges that humans are not always rational. Emotions, biases, and cognitive errors often lead to decisions that can negatively impact investment outcomes.

For example, have you ever bought a stock because everyone else was buying it, only to see its value drop? Or maybe you’ve held onto a losing investment for too long because you didn’t want to admit you were wrong. These are common examples of how behavior can influence investing.

Why Is Behavioral Finance Important?

Understanding behavioral finance is important because it helps you recognize and manage the emotional and psychological factors that can affect your investment decisions. By being aware of these influences, you can make more rational, informed choices and avoid common pitfalls that many investors fall into.

Common Behavioral Biases in Investing

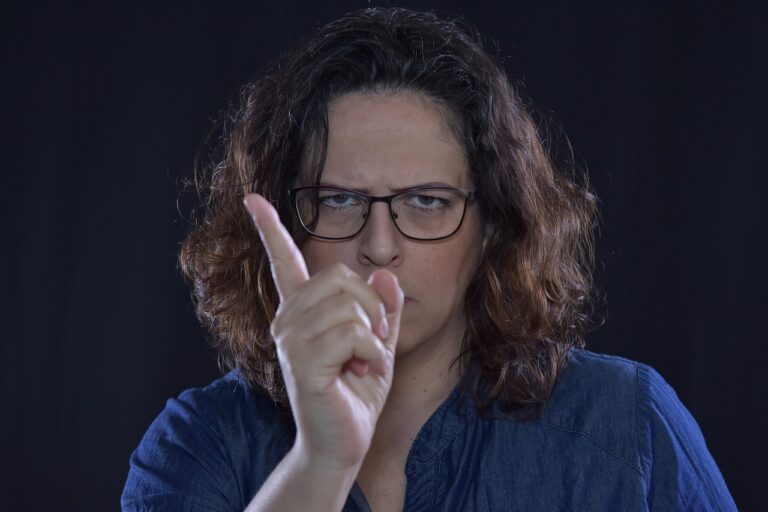

Let’s look at some common behavioral biases that can impact your investment decisions:

- Overconfidence Bias: Overconfidence is when investors believe they have better knowledge or skills than they actually do. This can lead to taking excessive risks or trading too frequently, which can hurt investment returns. For example, an overconfident investor might ignore market warnings or believe they can time the market perfectly, which is rarely the case.

- Herding Behavior: Herding occurs when investors follow the crowd, buying or selling assets because everyone else is doing it. This behavior can lead to bubbles, where asset prices inflate beyond their true value, or to crashes, when everyone tries to sell at the same time. Herding is often driven by the fear of missing out (FOMO) or the belief that “everyone else must know something I don’t.”

- Loss Aversion: Loss aversion refers to the tendency to fear losses more than we value gains. This bias can cause investors to hold onto losing investments for too long, hoping they will bounce back, or to sell winning investments too early to lock in profits. Loss aversion can prevent investors from making rational decisions based on market conditions.

- Anchoring: Anchoring is the tendency to rely too heavily on the first piece of information encountered (the “anchor”) when making decisions. In investing, this might mean sticking to a target price or a past investment performance as a reference point, even when market conditions change. Anchoring can lead to missed opportunities or holding onto investments that no longer fit your strategy.

- Confirmation Bias: Confirmation bias occurs when investors seek out information that confirms their existing beliefs and ignore information that contradicts them. For example, if you believe a particular stock will perform well, you might only pay attention to positive news about the company and ignore negative reports. This bias can lead to poor investment decisions based on incomplete information.

How Behavioral Finance Can Improve Your Investing

Understanding behavioral finance can improve your investing in several ways:

- Increased Self-Awareness: By recognizing your own biases, you can take steps to manage them. For example, if you know you tend to be overconfident, you might decide to seek a second opinion before making investment decisions. Or, if you recognize that you’re prone to loss aversion, you might develop a more disciplined approach to selling losing investments.

- Better Decision-Making: Behavioral finance encourages you to think critically about your investment decisions and to base them on data and analysis rather than emotions. By focusing on long-term goals and avoiding knee-jerk reactions to market fluctuations, you can make more rational and effective investment choices.

- Avoiding Common Pitfalls: By understanding common behavioral biases, you can avoid some of the most common pitfalls that trip up investors. For example, by being aware of herding behavior, you can resist the urge to follow the crowd and instead stick to your own investment strategy.

- Developing a Long-Term Perspective: Behavioral finance teaches you to focus on the long term rather than short-term market movements. This perspective helps you stay calm during market volatility and avoid making impulsive decisions that can harm your portfolio.

Practical Tips for Managing Behavioral Biases

Here are some practical tips to help you manage behavioral biases in your investing:

- Set Clear Investment Goals: Having clear, long-term investment goals can help you stay focused and avoid being swayed by short-term market fluctuations. When you know what you’re working towards, it’s easier to make decisions that align with your objectives.

- Create a Written Investment Plan: A written investment plan serves as a roadmap for your financial decisions. It should outline your investment strategy, risk tolerance, and goals. When emotions run high, refer back to your plan to guide your decisions.

- Diversify Your Portfolio: Diversification is one of the best ways to manage risk and reduce the impact of behavioral biases. By spreading your investments across different asset classes, sectors, and regions, you can minimize the risk of making emotionally driven decisions.

- Practice Patience: Patience is a key trait of successful investors. Avoid the temptation to check your investments too frequently or to make changes based on short-term market movements. Remember that investing is a marathon, not a sprint.

- Seek Professional Advice: If you find it difficult to manage your emotions or biases, consider working with a financial advisor. An advisor can provide objective guidance, help you stick to your plan, and offer a different perspective on your decisions.

- Stay Educated: The more you know about investing and behavioral finance, the better equipped you’ll be to make sound decisions. Read books, take courses, and stay informed about market trends and financial strategies.

Conclusion

Behavioral finance is a crucial aspect of investing that helps you understand how emotions and biases can influence your decisions. By being aware of these factors and taking steps to manage them, you can make smarter, more rational investment choices. Remember, the key to successful investing is not just about picking the right stocks or timing the market—it’s also about understanding your own behavior and making decisions that align with your long-term financial goals. By incorporating the principles of behavioral finance into your investment strategy, you can build a more resilient and successful portfolio.