Behavioral finance is a field of study that examines how psychological influences and biases affect our financial decisions. While most of us like to think that we’re rational when it comes to money, the truth is that emotions and cognitive biases often lead us to make poor choices. Understanding these common behavioral finance mistakes can help you avoid them and make smarter financial decisions. In this blog, we’ll explore some of the most common mistakes and provide tips on how to steer clear of them.

1. Overconfidence in Your Abilities

One of the most common behavioral finance mistakes is overconfidence. Many people believe they have superior knowledge or skills when it comes to investing, which can lead to taking on too much risk. Overconfidence can make you underestimate the challenges and uncertainties of the market, leading to poor investment decisions.

How to Avoid It:

- Stay Humble: Recognize that even professional investors make mistakes. Avoid assuming you know more than the experts.

- Diversify Your Investments: Instead of putting all your money into one stock or asset, spread it across different types of investments to reduce risk.

- Seek Advice: Consult with a financial advisor to get a second opinion on your investment strategies.

2. Chasing Past Performance

Another common mistake is chasing past performance. This occurs when investors choose investments based on their recent success, assuming that the past will repeat itself. However, past performance is not always indicative of future results, and this approach can lead to disappointment.

How to Avoid It:

- Focus on Fundamentals: Instead of relying on past performance, consider the underlying fundamentals of an investment, such as its financial health and growth potential.

- Avoid Herd Mentality: Just because everyone else is investing in something doesn’t mean it’s a good choice. Make decisions based on your own research and financial goals.

- Stay Long-Term: Adopt a long-term perspective instead of trying to time the market or chase short-term gains.

3. Loss Aversion

Loss aversion is a psychological phenomenon where the pain of losing money is stronger than the pleasure of gaining it. This can lead to overly conservative investment strategies or the refusal to sell losing investments, hoping they’ll bounce back.

How to Avoid It:

- Set Clear Goals: Determine your financial goals and risk tolerance before investing. This will help you make decisions that align with your objectives, even when emotions run high.

- Accept Losses: Understand that losses are a part of investing. Sometimes, cutting your losses and moving on is the best decision.

- Rebalance Your Portfolio: Regularly review and adjust your portfolio to ensure it aligns with your risk tolerance and long-term goals.

4. Anchoring on the Purchase Price

Anchoring is when you fixate on a specific piece of information, such as the price you paid for an investment, and use it as a reference point for making future decisions. This can lead to holding onto losing investments for too long or being unwilling to buy more of a winning investment because it seems too expensive.

How to Avoid It:

- Focus on Current Value: Instead of focusing on the price you paid, consider the current value and future potential of an investment.

- Be Willing to Adjust: If new information suggests that an investment no longer aligns with your goals, be willing to sell, even if it means taking a loss.

- Consider Opportunity Costs: Holding onto a poor-performing investment means you’re missing out on potential gains elsewhere. Be open to reallocating your resources.

5. Following the Crowd

Following the crowd, or herd behavior, is when investors make decisions based on what others are doing rather than on their own analysis. This can lead to buying high and selling low, as popular investments often become overpriced before eventually declining in value.

How to Avoid It:

- Do Your Own Research: Make investment decisions based on thorough research and analysis, not on what everyone else is doing.

- Stick to Your Plan: Develop a financial plan based on your individual goals and stick to it, even when the market is volatile.

- Be Cautious with Trends: Just because an investment is trendy doesn’t mean it’s a good long-term choice. Evaluate whether it fits with your financial strategy.

6. Short-Term Thinking

Many investors fall into the trap of short-term thinking, making decisions based on immediate market movements rather than long-term goals. This can lead to frequent trading, higher fees, and missed opportunities for growth.

How to Avoid It:

- Adopt a Long-Term Perspective: Focus on your long-term financial goals rather than short-term market fluctuations.

- Avoid Frequent Trading: Frequent buying and selling can eat into your returns due to transaction fees and taxes. Stick to a strategy that minimizes unnecessary trades.

- Review Your Plan Annually: Instead of reacting to daily market changes, review your financial plan annually and make adjustments as needed.

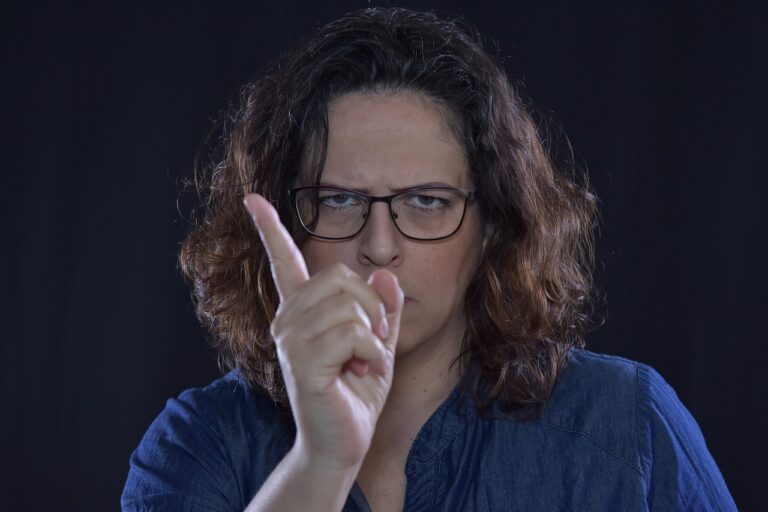

7. Emotional Investing

Emotions can play a significant role in investing decisions. Fear, greed, and excitement can lead to impulsive decisions that don’t align with your financial goals. For example, panic-selling during a market downturn or buying into a market bubble due to fear of missing out (FOMO) are common emotional responses.

How to Avoid It:

- Develop a Written Plan: Having a written investment plan can help you stay focused on your goals and reduce emotional decision-making.

- Practice Patience: Resist the urge to make impulsive decisions based on short-term market movements. Take time to consider your options and the potential impact on your long-term goals.

- Seek Professional Advice: If you’re struggling to keep emotions in check, consider working with a financial advisor who can provide objective guidance.

8. Ignoring Fees and Costs

Many investors overlook the impact of fees and costs on their returns. Whether it’s management fees, transaction fees, or taxes, these costs can add up and eat into your profits over time.

How to Avoid It:

- Choose Low-Cost Investments: Look for investments with low management fees and expense ratios. Index funds and ETFs are often more cost-effective than actively managed funds.

- Minimize Trading: Frequent trading can lead to high transaction fees. Stick to a buy-and-hold strategy to reduce costs.

- Be Tax-Efficient: Consider the tax implications of your investment decisions. Holding investments for more than a year can qualify you for lower long-term capital gains tax rates.

9. Failing to Diversify

Diversification is a key principle in investing, yet many investors fail to diversify adequately. Putting all your money into one stock, sector, or asset class can expose you to significant risk if that investment performs poorly.

How to Avoid It:

- Spread Your Investments: Diversify your portfolio across different asset classes, such as stocks, bonds, and real estate, as well as different industries and geographic regions.

- Rebalance Regularly: Periodically review your portfolio to ensure it remains diversified and aligned with your risk tolerance and goals.

- Avoid Concentration Risk: Don’t let any single investment make up too large a portion of your portfolio. Aim for a balanced mix of assets.

10. Neglecting to Reassess Goals

Finally, one of the biggest mistakes investors make is failing to reassess their financial goals over time. Life circumstances change, and your investment strategy should evolve accordingly. Whether it’s a career change, marriage, or nearing retirement, it’s important to review and adjust your plan regularly.

How to Avoid It:

- Schedule Regular Reviews: Set aside time at least once a year to review your financial goals and investment strategy.

- Adjust as Needed: Be willing to make changes to your portfolio as your goals and risk tolerance evolve.

- Stay Flexible: Life is unpredictable, and your financial plan should be adaptable to changing circumstances.

Conclusion

Avoiding common behavioral finance mistakes can significantly improve your investment outcomes. By staying aware of these pitfalls and following the strategies outlined in this blog, you can make more rational, informed decisions that align with your long-term financial goals. Remember, the key to successful investing is not just about picking the right stocks or assets but also about managing your behavior and emotions along the way. Stay disciplined, stay informed, and you’ll be well on your way to financial success.